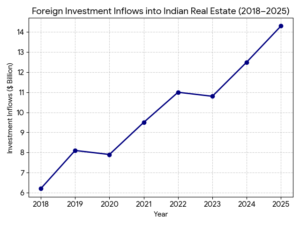

- Strong Investment Flows Amid Global Uncertainty

Despite periodic global economic headwinds through 2025, India’s real estate sector has remained resilient, attracting significant capital from abroad and domestic investors alike.

- According to industry reports, India’s total real estate investment in 2025 reached a record ~$14.3 billion, a ~25% year-on-year increase, with major contributions from institutional and foreign investors.

- In the first half of 2025 alone, institutional capital inflows into Indian real estate reached approximately $3.1 billion.

- A separate analysis found that foreign investors’ share in total capital invested increased from 68% in 2024 to ~84% in 2025, signaling renewed confidence.

Why this matters: India’s real estate is seen as a long-term bet with stable yields, especially in office and residential assets — even as some private equity investment patterns fluctuated in the mid-year.

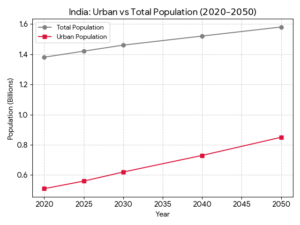

Demographics: A Young, Urbanizing Population

Demographics: A Young, Urbanizing Population

India’s demographic profile continues to be one of its strongest investment fundamentals:

- India has one of the youngest populations globally, with a median age in the mid-20s — a key driver of housing and rental demand as more people enter the workforce.

- Urbanization is accelerating: estimates suggest that India’s urban population — currently ~37% — could rise to over 50% by 2050; this shift fuels demand for housing, workplaces, and urban infrastructure across emerging cities.

Investor takeaway: A youthful workforce and expanding cities translate into persistent demand for residential, office, and rental assets, which anchor long-term capital returns.

- Policy Reforms and Regulatory Improvements

India’s regulatory landscape has steadily evolved in favor of transparency and investor protection:

- The Real Estate (Regulation and Development) Act, 2016 (RERA) continues to enforce project registration, delivery timelines, and accountability, improving market trust and reducing developer risk profiles.

- Tax incentives, streamlined land procedures, and reforms in property rights and dispute resolution have strengthened investor confidence (evident from rising overseas capital commitments).

- Infrastructure corridors (such as expressways and metros) and urban development schemes — including Smart Cities and metro expansions — further enhance real estate yield potential.

These reforms collectively make India’s markets more transparent, predictable, and integrated with global capital standards.

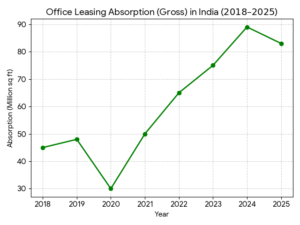

- Urbanization and Infrastructure: Shaping New Growth Corridors

Real estate growth is closely aligned with infrastructure development:

- Connectivity improvements like the Rapid Metro expansion in Gurgaon — with extensions tying major employment hubs and transit nodes — are boosting demand and price appreciation.

- New corridors such as the Southern Peripheral Road (SPR) and Dwarka Expressway have become hotspots for real estate projects, attracting billions in development capital due to enhanced accessibility.

Such megaprojects unlock previously under-served micro-markets, giving investors varied choices from premium to mid-segment assets.

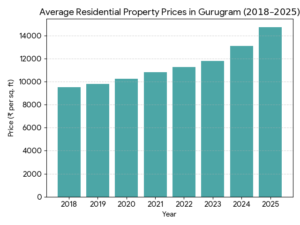

- Gurgaon (Gurugram) — A Case Study in Real Estate Magnetism

Investment & Development Numbers (2025)

Gurgaon’s real estate market stands out within the Delhi-NCR region:

- ₹87,000+ crore worth of projects were registered in Gurugram in 2025 across 131 developments — signaling robust investor interest and ongoing growth in both residential and mixed-use space.

- Prime residential prices in Gurugram averaged ~₹14,600–₹19,300 per sq. ft by late 2025, underscoring strong demand for urban living spaces.

- Year-on-year, certain NCR property prices including Gurgaon spiked by ~24%, reflecting sustained capital appreciation.

Drivers Behind Gurgaon’s Attraction

- Corporate & Employment Growth

Gurgaon is not just a residential hub — it’s a corporate ecosystem. Major multinational firms, IT/ITES players, and services companies have established campuses here, creating:

- Steady office leasing demand

- Strong workforce-driven housing demand

- Infrastructure Expansion

Projects like Dwarka Expressway, SPR, and metro extensions connect Gurgaon with Delhi, IGI Airport, and other NCR nodes — boosting livability and property values. - Diverse Investment Options

From luxury segments to mid-market housing and rental-yield assets, Gurgaon offers a portfolio of real estate products appealing to both foreign and domestic investors. - Regulatory Stability

RERA-registered projects and transparent approvals continue to enhance investor confidence, making Gurgaon a lower-risk choice within the Indian landscape.

A Sustainable Growth Story

In 2025, India’s real estate remains a top destination for foreign capital due to a combination of:

- A young, urbanizing population demanding housing and jobs;

- Policy reforms that enhance transparency, protect buyers, and unify markets;

- Strong infrastructure-led growth reshaping urban landscapes; and

- Local success stories like Gurgaon’s booming property market, which exemplify the confluence of demand, connectivity, and capital inflows.

While global economic conditions can affect quarterly investment patterns, India’s macro fundamentals, combined with rapid urban transformation, position it as a compelling destination for real estate capital in the years ahead.