Regulatory changes, FDI trends, and investor opportunities in Indian real estate

Introduction

India’s foreign direct investment (FDI) framework is undergoing a structural transformation, creating significant momentum across the Indian real estate and property investment landscape. In FY 2024–25, strong FDI inflows, combined with regulatory reforms and digitisation initiatives, have reinforced India’s position as a preferred destination for global real estate capital.

For foreign investors—ranging from institutional funds and family offices to REIT sponsors and NRIs—the evolving policy environment has reduced entry barriers, improved transparency, and expanded viable investment routes across commercial, residential, logistics, and alternative real estate assets.

FDI Inflows in India: Key Highlights (2024–25)

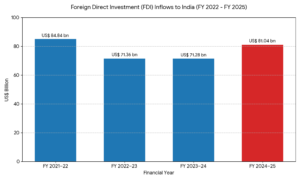

India recorded US$81.04 billion in gross FDI inflows in FY 2024–25, marking a 14% year-on-year increase and the highest inflow level in three years. Equity inflows alone exceeded US$50 billion, signalling strong long-term investor commitment rather than short-term portfolio activity.

Sector-wise FDI Leaders

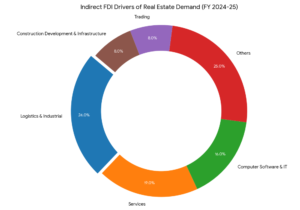

While real estate is not always classified independently, property demand is directly influenced by FDI inflows into:

- Services sector

- Technology and IT-enabled services

- Financial services and capital markets

- Infrastructure, logistics, and manufacturing

These sectors continue to drive absorption of Grade-A office space, data centres, logistics parks, and urban housing, strengthening the investment outlook for Indian property markets.

Regulatory Changes Influencing Property Investment

1. Liberalised FDI Policy and Automatic Route

India’s FDI regime remains one of the most liberal among emerging markets. 100% foreign ownership under the automatic route is permitted across most real estate-linked activities, including:

- Township and infrastructure development

- Construction-development projects (subject to conditions)

- REITs and InvITs

- Property-holding and operating companies

This has significantly reduced regulatory friction, shortened approval timelines, and enhanced transaction certainty for foreign investors.

2. Press Note 3: Clarifications and Stability

Press Note 3 continues to require government approval for investments from select jurisdictions. However, clarifications and exemptions introduced in 2024–25, particularly for multilateral institutions and restructuring transactions, have improved predictability for institutional investors structuring India exposure.

3. RBI’s FPI-to-FDI Reclassification Framework

The Reserve Bank of India introduced guidelines allowing foreign portfolio investors (FPIs) crossing prescribed thresholds to reclassify holdings as FDI. This reform supports long-term capital participation in listed real estate companies, REIT sponsors, and holding platforms.

Impact:

These regulatory updates collectively encourage stable, long-horizon capital flows into asset-heavy sectors such as real estate and infrastructure.

Real Estate-Specific Reforms Driving FDI

Digitisation of Land Records: A Structural Enabler

One of the most critical reforms for foreign property investors is the near-completion of India’s Digital Land Records Modernisation Programme (DLRMP).

Key milestones include:

Key milestones include:

- 99.8% digitisation of land records

- 97.3% digitisation of cadastral maps

- 100% computerisation of sub-registrar offices

Why Digitised Land Records Matter

- Reduced title ambiguity and legal disputes

- Faster due diligence and transaction closures

- Improved lender and institutional underwriting confidence

For the first time, India’s land governance framework aligns closely with global institutional investment standards, significantly improving risk visibility for foreign investors.

FDI and Institutional Investment in Indian Real Estate

According to industry estimates:

According to industry estimates:

- The Indian real estate sector attracted approximately US$5.8 billion in FDI in FY 2023–24

- Momentum continued into FY 2024–25, driven largely by commercial office and logistics assets

In Q2 2025, foreign institutional investment in Indian real estate surged 242% quarter-on-quarter, reaching nearly US$1.2 billion, with around 69% allocated to commercial real estate.

This trend reflects global investor preference for income-generating, scalable, and governance-compliant assets.

Key Property Segments Benefiting from New FDI Policies

1. Commercial Office Real Estate

India remains one of the world’s largest office absorption markets, supported by:

- Expansion of Global Capability Centres (GCCs)

- Growth in technology and financial services

- Availability of cost-efficient, Grade-A office stock

Markets such as Bengaluru, Mumbai, Delhi NCR, Hyderabad, and Pune continue to attract institutional capital.

2. Logistics and Industrial Parks

FDI interest in logistics and industrial real estate is rising due to:

- E-commerce expansion

- Manufacturing-led growth policies

- Improved land title clarity from digitisation

Warehousing clusters and integrated industrial parks are emerging as preferred long-term investment themes.

3. Residential Real Estate and NRI Investments

Non-Resident Indians (NRIs) remain a stable source of residential demand, particularly in premium and mid-income housing. RERA enforcement, regulatory stability, and digitised documentation have strengthened buyer confidence across major Indian cities.

4. REITs and Platform Investments

REITs and structured real estate platforms offer:

- Stable yield visibility

- Professional asset management

- Regulated governance frameworks

- Lower execution risk compared to direct development

India’s REIT ecosystem continues to deepen, supported by favourable FDI and capital market regulations.

Challenges and Risk Considerations

Despite strong reform momentum, foreign investors should evaluate:

- Gross vs net FDI trends, reflecting repatriation and exits

- State-level variations in land and registration processes

- Regulatory approvals for select transactions

- Project-specific compliance and exit structuring

Partnering with experienced local advisors remains critical for risk-adjusted investment outcomes.

The 2024–25 FDI policy environment marks a decisive inflection point for Indian property investments. Liberalised ownership norms, digitised land systems, and evolving capital market frameworks have significantly enhanced India’s appeal as an institutionally investable real estate destination.

For global investors seeking long-term exposure to a high-growth economy with improving governance and structural demand drivers, Indian real estate—across commercial, logistics, residential, and REIT formats—offers compelling and scalable opportunity.