For many founders, the word exit feels premature—almost disloyal—when spoken in the early days of a venture. After all, shouldn’t startups be built on passion, vision, and long-term belief rather than spreadsheets and sale scenarios?

Institutional investors see it differently.

To them, building for exit from day one is not about selling early. It is about designing a company that can withstand scrutiny, scale with discipline, and outlive its founders. Ironically, startups that embrace institutional thinking early often build stronger, more resilient, and more valuable businesses—whether they exit or not.

What “Building for Exit” Really Means

Building for exit does not mean:

• Optimising purely for valuation optics

• Chasing short-term growth at the cost of fundamentals

• Designing products only to be acquired

It does mean:

• Designing governance, systems, and culture as if an external owner will one day inherit them

• Creating clarity in economics, decision-making, and accountability

• Ensuring the business can scale without heroics

Exit thinking forces maturity. It pushes founders to build companies that can stand on their own—independent of personalities and momentary momentum.

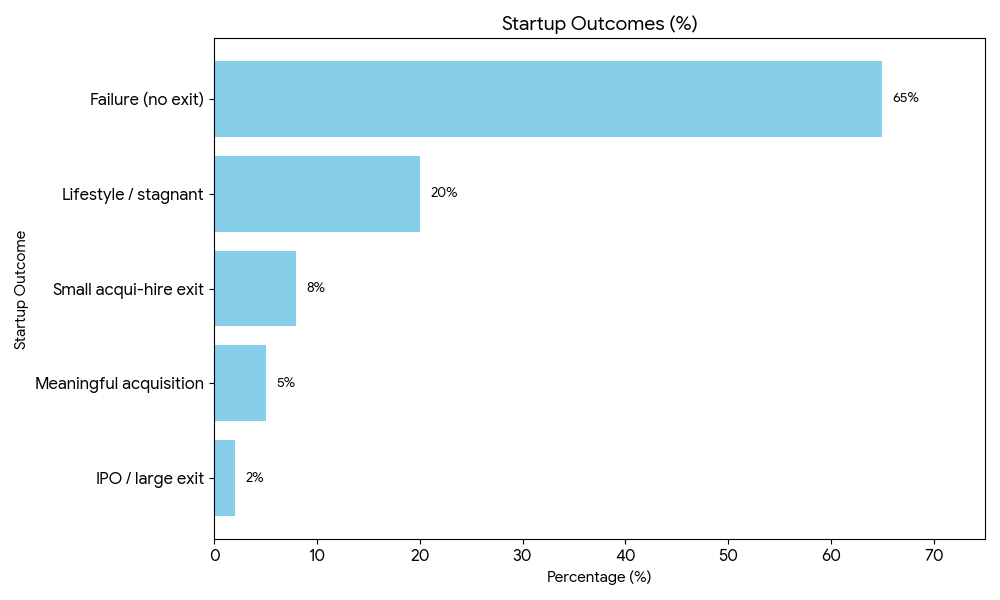

The Data: Why Most Startups Fail to Exit Well

Let’s anchor this discussion in reality.

Key insight:

Only ~7% of startups achieve a meaningful exit (large acquisition or IPO). The difference is rarely just product quality—it is institutional readiness.

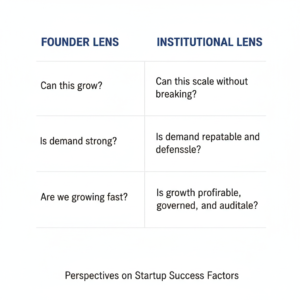

Institutional Thinking: The Invisible Advantage

Institutional investors—private equity funds, sovereign capital, family offices, and large venture firms—evaluate startups through a fundamentally different lens.

Founder Lens Institutional Lens

This lens shapes better companies, even if an exit takes 10–15 years.

1. Governance from Day One: Clarity Over Control

Many early-stage startups avoid governance, viewing it as bureaucracy. Institutions see it as risk insurance.

What good governance enables:

• Faster diligence during funding or acquisition

• Clear accountability in decision-making

• Reduced founder risk and internal conflict

Early signals of exit-ready governance:

• A clean cap table with documented vesting

• A board or advisory structure with defined roles

• Founder agreements that survive scale

Institutional truth:

A company without governance doesn’t look “agile”—it looks uninvestable.

2. Unit Economics Before Scale: Discipline Over Noise

One of the most common reasons exits collapse late in the process is unclear or fragile unit economics.

The institutional question:

“If we stop growth tomorrow, does the business still make sense?”

Why this matters:

• Acquirers buy predictability, not just momentum

• Public markets punish unclear economics brutally

• Capital efficiency signals leadership maturity

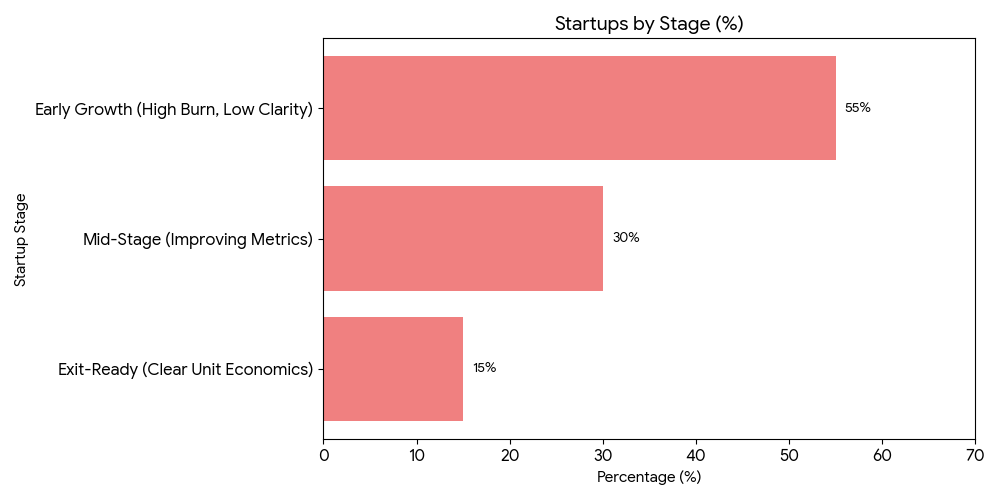

Only ~15% of startups reach a stage where growth is both scalable and economically transparent.

3. Systems That Scale Without Founders

A business that depends on the founder for every major decision is not exit-ready—it is fragile.

Institutional thinking asks:

• Can this company operate for 90 days without the founder?

• Are decisions documented or tribal?

• Are processes repeatable across teams and geographies?

Exit-oriented design includes:

• Documented SOPs

• Delegated authority matrices

• Data-driven dashboards instead of instinct-led decisions

Counter-intuitive insight:

The more replaceable the founder appears operationally, the more valuable the founder becomes strategically.

4. Responsible Scaling: Growth That Survives Scrutiny

Hypergrowth without structure often looks impressive—until diligence begins.

What institutions look for:

• Compliance readiness (legal, tax, data)

• Risk frameworks (customer concentration, vendor exposure)

• ESG and reputational awareness (increasingly non-negotiable)

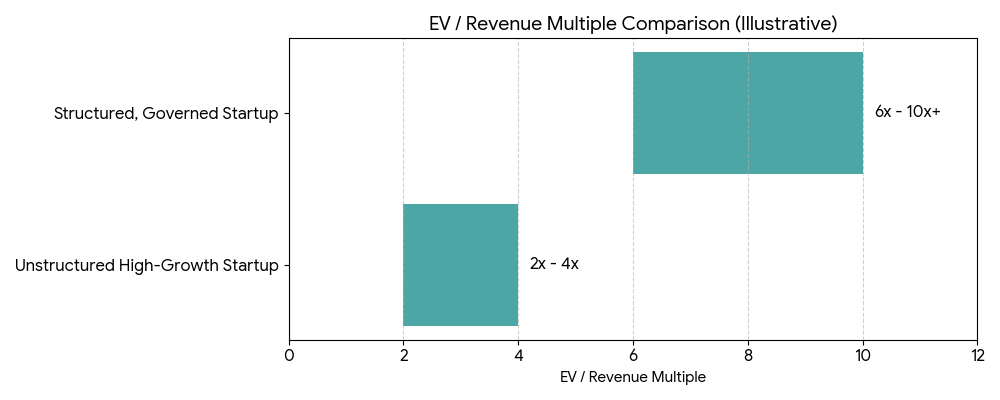

Why responsible scaling wins:

• Reduces post-acquisition integration risk

• Improves valuation multiples

• Attracts long-term capital, not speculative money

Markets pay premiums for clarity, not chaos.

5. Exit Thinking Improves Founder Outcomes

Designing for exit does not diminish founder vision—it protects it.

Founders who adopt institutional thinking early:

• Face fewer down-rounds

• Retain negotiating leverage

• Experience cleaner exits with fewer earn-outs and disputes

In contrast, poorly structured startups often:

• Lose control during crisis funding

• Get acquired under distress

• Exit on paper—but not in reality

The Paradox: Build for Exit, Build to Last

Some of the world’s most enduring companies were built with exit discipline, even when exits never came:

• Strong governance

• Clean economics

• Scalable systems

• Institutional credibility

Exit thinking does not shorten vision—it forces clarity.

Final Thought

Building for exit from day one is not about planning to leave.

It is about respecting capital, time, and responsibility.

Startups that design themselves as if an institution will one day take over:

• Scale more responsibly

• Survive longer

• Attract better partners

• Exit on their own terms—if and when they choose

In a world where capital is more selective and scrutiny is unforgiving, institutional thinking is no longer optional. It is the quiet architecture behind the startups that truly endure.